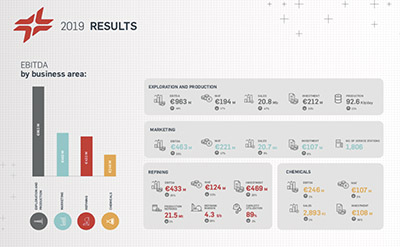

- Cepsa achieved Clean CCS EBITDA of €2,058 million, with the Exploration and Production and Marketing businesses units' positive performance being a highlight

- Adjusted net profit was €610 million, in an environment of lower refining margins and lower crude prices than those observed in 2018

- Investments in this period amounted to €924 million and free cash flow, before interest and dividend payments, was €1,152 million

During 2019, Cepsa recorded Clean CCS EBITDA (Clean CCS EBITDA) of €2,058 million, 17% higher than the previous year, when it stood at €1,762 million.

The 17% increase in Clean CCS EBITDA was mainly due to the positive performance of the Exploration and Production business unit and the Marketing business unit (with increases of 48% and 35%, respectively, compared to the same period in 2018).

Cepsa's adjusted net profit in 2019 was €610 million, while in 2018 it was €754 million. This decrease is attributable to an environment of low refining margins, especially in the first and final quarter of the year, as well as the lower margins of certain chemical products.

Applying International Financial Reporting Standards (IFRS) and calculating inventory movements at average unit cost, the accumulated net income for the financial year is €820 million, compared to €830 million in 2018.

In 2019, Cepsa optimized its capital structure, extending the average term of its debt to over five years. Likewise, the cash generated during the year has allowed Cepsa to reduce net debt by 11%, to €2,746 million, compared to December 2018 (excluding the impact of IFRS 16). The Net Debt/EBITDA ratio stood at 1.4x, four tenths lower than at the close of 2018 (1.8x).

Investment during the period amounted to €924 million and free cash flow was €1,152 million (before the payment of interest and dividends). The Company has made significant investment into the development of the Abu Dhabi fields, as well as projects in the Refining business unit aimed at optimizing refineries.

In 2019, the price of Brent crude averaged $64.3 per barrel, 9% below the average of $71.0 per barrel in 2018. Similarly, the (VAR) refining margin indicator fell to $4.3 per barrel in 2019 compared to $6.1 per barrel the previous year.

In terms of safety, the LWIF (Lost Workday Injury Frequency) rate, which measures the number of accidents resulting in absence from work, was 0.87 accidents per million hours worked in 2019, in line with the results from 2018. With respect to greenhouse gas emissions, the level of CO2 per ton produced remained at levels similar to those of the previous year.